How a Bookkeeper Can Help Assist a Business in Financial Trouble

Bookkeepers can play a crucial role in identifying the signs of a small business in debt. By closely monitoring the financial records and analysing key financial indicators, they can spot warning signs that indicate a business may be struggling with debt.

Bookkeepers often have the first opportunities to observe changes in a business, both positive and, unfortunately, negative. By getting involved with their clients by asking questions and testing their clients’ knowledge of the business and its key performance indicators, they can spot the danger signs that trouble is approaching or at hand.

Typically, it is not just one factor that points to the demise of a business;

it is generally a culmination of factors, such as:

- A lack of working capital.

- An overall asset deficiency.

- The inability to meet financial obligations.

- Creditors being paid outside of their trading terms.

- The inability to raise further capital or obtain further borrowings.

- Tight cash flow leading to juggling payments.

- Making special arrangements with creditors or favouring certain creditors.

- Overdue state and federal taxes.

- Poorly maintained accounting records.

- Rent not being paid on time.

- Employees not being paid all their entitlements, particularly superannuation.

Bookkeepers maintain awareness of the business and are prepared to assist in various ways, including recommending the use and engagement of Insolvency and Business Recovery Services in some instances.

Recognising financial distress indicators and understanding potential insolvency risks empowers a Bookkeeper to guide businesses toward seeking professional help at the right time. Collaborating with insolvency experts can provide struggling businesses with strategic recovery plans, debt restructuring, and legal guidance to navigate through challenging financial situations.

By offering this recommendation, Bookkeepers contribute to the overall well-being of the business and its stakeholders, ensuring informed decisions are made to achieve the best possible outcome.

Business Owners can become more receptive once a discussion is had. Starting the conversation about cash flow and the business levers that control this cash flow helps the business owner to use a cash flow analysis. This looks at all factors impacting the business and the business’s working capital requirements that need to be looked at. Producing a cash flow analysis can provide clear answers and consider what levers they can pull to manage cash flow better.

Bookkeepers can assist in helping a business owner to understand cash flow. The Bookkeeper needs to be involved in the discussion around financial challenges as they hold the core data and can drill down to more information. The Bookkeeper understands the business and the complexity of the accounting file and should be involved in the discussions.

How Bookkeepers Can Help

Once debt problems are identified, Bookkeepers can assist small business owners in developing strategies for recovery. A Bookkeeper works closely with business owners and insolvency experts to create realistic budgets, establish debt repayment plans, and negotiate with creditors. Bookkeepers can help business owners prioritise debts, explore options for extended payment terms or reduced interest rates, and liaise with creditors on behalf of the business.

Get Ahead of Any Issues

Up to date reports and reviews of business information provide visibility to the business. They should lead to raising strategies to improve the business performance, which means a greater understanding of what the business needs to do and when to ask for help and the support options available to them. It’s never too late to ask for help.

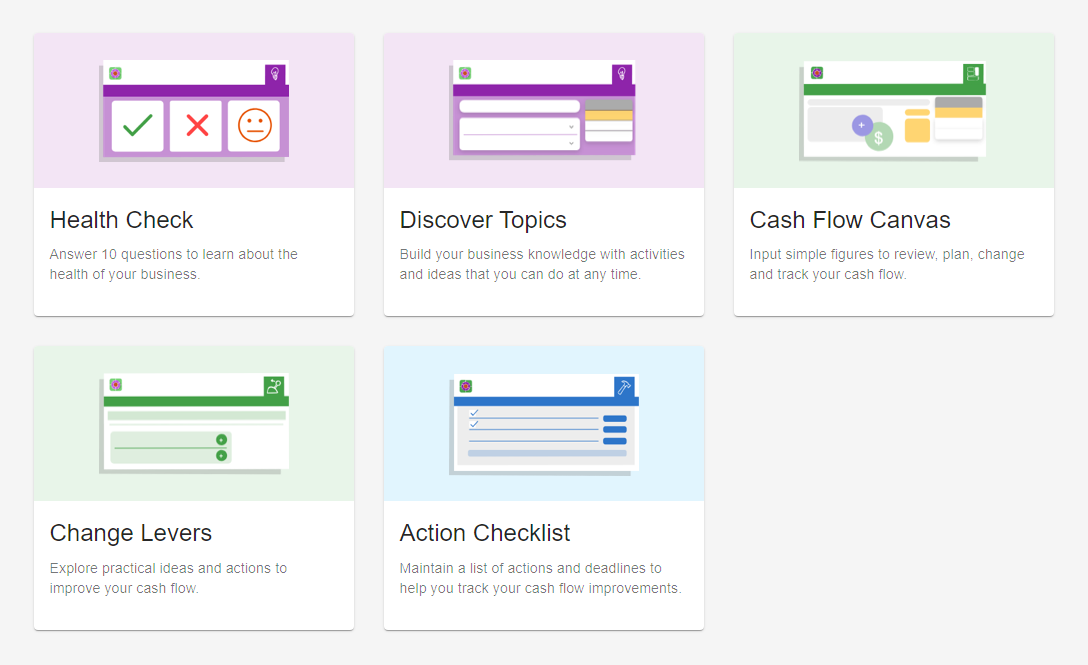

Cashflow Coaching Kit

The ATO Cash Flow Coaching Kit is a resource designed for trusted advisers to help small businesses build their cash flow capability, meet financial commitments and remain viable. Good cash flow management is critical to the ongoing success of any business, whether a small business or a large corporation; cash flow is the lifeblood. Helping a business develop and implement a budget can help plan and direct money where it matters the most.

What is the Cash Flow Coaching Kit

The Cash Flow Coaching Kit can assist Bookkeepers and Business Owners to work together when analysing financial difficulties. This will assist with making important changes as early as possible that could make a significant difference in any business. The kit helps build cash flow capability for those new to business during financial stress or unexpected events.

The Cash Flow Coaching Kit is a flexible and practical resource, crucial at this time for all Business Owners.

Source: ATO – Cash Flow Coaching Kit

This educational coaching product allows for a Bookkeeper and a Business Owner, together, to establish cash flow capability, structured around a framework that simplifies cash flow management principles into four key questions. The kit caters to all business types at any stage in the business lifecycle.

By working through the questions in the kit, the small business owner and their advisor are provided with insight into the owner’s understanding of the business’s health, especially their cash flow position.

- Profit: Are you trading profitably?

- Provisioning: Have you put enough aside to meet your regular financial commitments?

- Liquidity: Does your business have enough to spend on yourself and pay others?

- Meeting Goals: Is your business improving its financial position?