Obtain a Director ID Now or Get Penalised!

All directors of a company, registered Australian body, registered foreign company or Aboriginal and Torres Strait Islander corporations are now required to obtain a director ID.

A director ID is a unique identifier that a director will apply for once and keep forever and is aimed at preventing the use of false or fraudulent director identities.

If your small business is set up under a proprietary limited (“Pty Ltd”) structure then you are most likely a company director. Anyone else closely involved in your business – typically a spouse, sibling, or parent – could also be a director.

Directors of a company will appear on the company’s ASIC extract, a listing of the company details that is held with the Australian Government.

What Does it Mean to Have a Director ID?

The Director ID will be a unique identifier that a Director will keep forever, enabling regulators to better track Directors of failed companies who use fabricated identities. The introduction of these IDs is aimed at preventing the use of false or fraudulent director identities. Regulators will be helped to trace directors’ relationships with companies over time and better identify director involvement in unlawful activity. The new system will help overcome issues with data integrity, which have always been a constant battle in regulating phoenixing and the illegal activities around this dilemma. This compliance regulator will further support small businesses by keeping out operators that are breaking the law.

The Law Applies Now – Penalties Soon

- New Directors / New Entities:

- Since 5th April 2022: a person must apply before being appointed as a director.

- Existing Directors / Existing Entities:

- Must obtain ID prior to 30th November 2022 (transition period).

- Future Directors:

- A person who intends to be appointed, may apply up to 12 months before.

- Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act) have an extra 12 months. Current CATSI Act directors must apply by 30th November 2023.

- Charities & NFP Sector:

- Directors of incorporated associations registered with the ACNC do not need a Director ID. A very limited exception to this is directors of incorporated associations that have an Australian Registered Body Number (ARBN) to operate outside their ‘home’ state or territory. Directors of an incorporated association with an ARBN will need a director ID even if they are not ACNC registered.

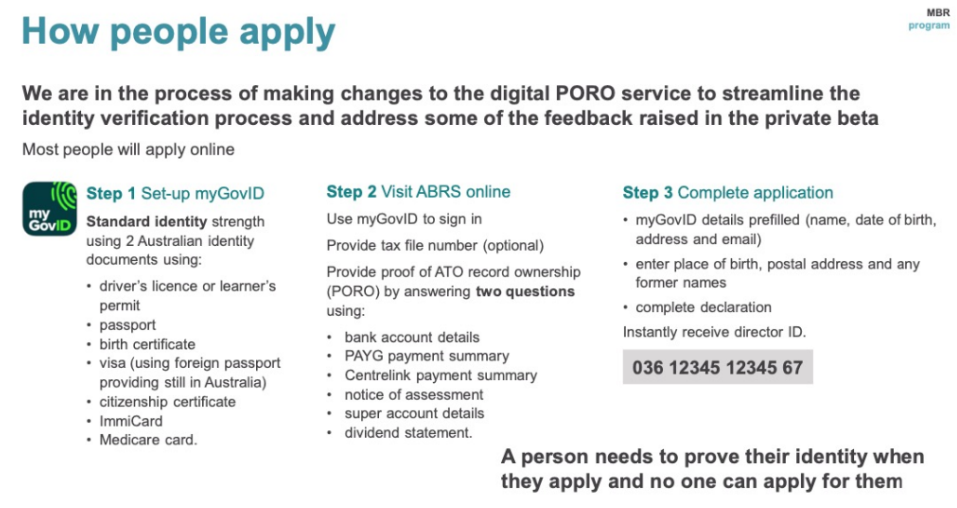

Australian Business Registry Services (ABRS) is responsible for administering director ID and will provide support and guidance to directors to assist them to understand and meet their director ID obligation. Please visit the ABRS website for more information about director ID.

Your Bookkeeper’s Role

- Bookkeepers cannot apply for a business owner (even if they log you in).

- Bookkeepers cannot advise to set up companies / trusts etc. It is tax and legal advice that is out of scope for Bookkeepers and BAS Agents and has too many legal consequences.

- Bookkeepers can provide information – help your businesses to understand and implement the Director ID process.

- Bookkeepers cannot pretend they are the client and apply for them.

- A Bookkeeper can only help the business owner.

- Directors must apply themselves – using their myGovID.

There has now been further clarification regarding the penalties which will be imposed.

Directors who fail to apply within the time frame could face fines of up to 5,000 penalty units. Currently, penalty units are measured at $222 per unit for breaches of Australian Government Law, which means fines of up to $1.1 million may apply. There is also the consequence of possible imprisonment for up to 12 months.

Additionally, further penalties may be imposed on directors who knowingly apply for multiple director IDs, misrepresent their identification numbers to a Government or registered body, or provide false information during their application process.